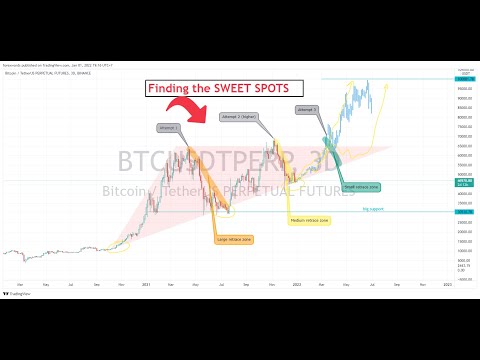

Finding the “Sweet Spot” for Cryptocurrency Trading

It's no secret that cryptocurrency is one of the most volatile asset classes on the market right now. Bitcoin prices have fluctuated by roughly 30% in a single session. Trading in Bitcoin or any other digital asset allows you to wager on volatility. Buying both a call and a put option at the same time is one way to go about it. Both the strike price and the expiration date must be the same. When crypto prices fall or climb sharply, you must simultaneously sell the call and put options to exit.

Crypto trading is a short-term trading strategy based on the purchase and sale of crypto assets over a relatively short period.

Cryptocurrency trading is a high-risk venture due to the volatility and liquidity in the cryptocurrency markets.

A trader should have a good understanding of crypto and trading fundamentals regardless of the market. Only put your money where you're willing to lose it. Here's all you need to know to start day trading crypto if you have immaculate risk management abilities and steely nerves.

Regardless of your style or trade setups, you need to find the sweet spot or the trade trigger to enter a trade; just finding a setup doesn’t lead you to high probability trades. Knowing when to enter the market is what is essential.

Please visit and watch my other videos and please subscribe @Investor Trading Academy

It's no secret that cryptocurrency is one of the most volatile asset classes on the market right now. Bitcoin prices have fluctuated by roughly 30% in a single session. Trading in Bitcoin or any other digital asset allows you to wager on volatility. Buying both a call and a put option at the same time is one way to go about it. Both the strike price and the expiration date must be the same. When crypto prices fall or climb sharply, you must simultaneously sell the call and put options to exit.

Crypto trading is a short-term trading strategy based on the purchase and sale of crypto assets over a relatively short period.

Cryptocurrency trading is a high-risk venture due to the volatility and liquidity in the cryptocurrency markets.

A trader should have a good understanding of crypto and trading fundamentals regardless of the market. Only put your money where you're willing to lose it. Here's all you need to know to start day trading crypto if you have immaculate risk management abilities and steely nerves.

Regardless of your style or trade setups, you need to find the sweet spot or the trade trigger to enter a trade; just finding a setup doesn’t lead you to high probability trades. Knowing when to enter the market is what is essential.

Please visit and watch my other videos and please subscribe @Investor Trading Academy

- Category

- Cryptocurrencies

Be the first to comment